01 November 2024

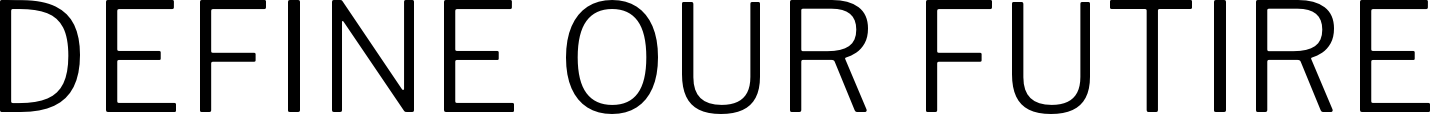

(Image Render: Adobe)

In an article from June 21, we examined China’s rising role as a leader in space exploration and development. We explored how China's approach mirrors its global ambitions to offer alternative paths for global progress, similar to initiatives like the Belt and Road Initiative (BRI). This ambition is evident in China's invitation to expand its cooperation, exemplified through projects like the Tiangong Space Station and the International Lunar Research Station (ILRS). The growing space leader seems committed to this path, showing no signs of slowing down.

Writing in Foreign Affairs in June, Elizabeth Economy argued that China is providing an alternative global system that “advances the interests of the world’s people,” citing President Xi’s statement that China has established the “largest platform for international cooperation” (Foreign Affairs, 2024). China also appears to be strengthening ties with the United Nations and, in space governance, preferring to remain closely aligned with the UN, as appose to a US-led Artemis Accords model.

China’s policy of open international collaboration was praised this week by Global Times, which noted China’s efforts to create an “excellent platform” for international cooperation on lunar exploration. By last year, China had signed over 150 intergovernmental agreements with more than 50 countries and international organisations (Global Times, 2024).

Interestingly, the Global Times described lunar exploration as both “competition and collaboration”, a concept that seems increasingly relevant as the US-China race unfolds. According to a statement by the China Manned Space Agency (CMSA) on Tuesday, China is advancing plans for a crewed lunar landing with the goal of reaching the Moon by 2030. CMSA also announced the selection of two teams from the China Academy of Space Technology (CAST) and the Shanghai Academy of Spaceflight Technology (SAST) to develop a lunar rover to transport taikonauts over short distances on the Moon.

Additionally, this week, the Shenzhou-19 crew heading to the Tiangong station will conduct experiments with “lunar bricks” made from simulated lunar soil to test their viability for constructing their future lunar base. While the US still leads with more countries signed onto its Artemis Accords, China’s steady progress and partnerships indicate an increasingly competitive race.

Boeing Reportedly Looking to Sell Space Business – Sign of an Industry Shift?

China’s ascent in space signals a new era, transitioning from an industry once dominated by a few national agencies to one led by diverse stakeholders, including new spacefaring nations, commercial players, and civil society.

Last Friday, The Wall Street Journal reported that Boeing, once a leader in space technology, responsible for developing the Saturn V rockets and the Space Shuttle, is considering exiting the space sector. Plagued by delays and cost overruns in its Starliner program, Boeing has struggled to compete with SpaceX in transporting crew and cargo to the ISS. Similar issues have impacted its work on NASA’s Space Launch System (SLS) rocket, with ongoing engineering setbacks and budget excesses. Meanwhile, Airbus also recently announced layoffs, planning to cut 2,500 jobs in its space and defence sectors by 2026.

SpaceX now dominates space launches and is advancing the development of its heavy-lift reusable vehicle, Starship. Meanwhile, companies like Sierra Space, Voyager, and Vast are pioneering new alternatives to the aging IS, arenas once dominated by Boeing. These challenges highlight an industry shift, as legacy companies are increasingly overshadowed by younger, more agile competitors.

Lupex rover illustration (Image: Terry White/SLS)

Boeing’s Setbacks as Opportunities for New Players

In November 2023, the European Space Agency (ESA) decided to embrace a commercial approach to rocket development. Rather than build its own rockets, ESA will now stimulate competition and purchase launch services “as an anchor customer,” according to ESA Director Josef Aschbacher. This decision could mark a turning point for Europe, with the new Ariane-6 rocket possibly the last of a legacy series as ESA shifts to procuring services instead of commissioning rockets.

In line with this strategy, ESA announced this week that it awarded contracts to four European companies to develop reusable rocket technologies. The Technologies for High-thrust Reusable Space Transportation (THRUST!) project will fund The Exploration Company (Germany/France) to develop its Typhoon engine, while Rocket Factory Augsburg will create a new engine for the initiative. The Boosters for European Space Transportation (BEST!) project will support reusable booster tech from ArianeGroup (France) and Isar Aerospace.

ESA is also exploring ways to support the European space industry amid challenges like Boeing’s job cuts, potentially marking a moment for Europe to assert its presence on the global space stage.

Could Musk and Bezos’ Politics Open Doors for Competitors?

On Wednesday, October 30, Blue Origin rolled out the first stage of its much-anticipated New Glenn rocket, poised to challenge SpaceX’s Falcon 9. With a larger payload capacity to Low Earth Orbit (LEO) and a fully reusable first stage, New Glenn could become a formidable rival.

However, Blue Origin found itself in the spotlight this week amid reports of meetings with former President Donald Trump. Simultaneously, Bezos banned political campaigning within The Washington Post, sparking controversy and resulting in 200,000 canceled subscriptions. Bezos has stated there is no connection between these events, though the implications for Blue Origin remain uncertain.

Meanwhile, Elon Musk, an outspoken supporter of Trump, recently stated that a Trump administration would benefit SpaceX by reducing regulatory hurdles. Adding to the controversy, The New York Times reported that Musk has held confidential meetings with Vladimir Putin over the past two years, prompting NASA Administrator Bill Nelson to voice concerns. Pentagon officials have also expressed unease about SpaceX developing spy satellites for them, especially given Musk's alleged connections to Putin.

Coincidentally or not, the US Space Force opened applications this week for national security missions from emerging launch providers, possibly signalling new opportunities for companies like Firefly, Rocket Lab, Astra or Relativity Space.

As the value of space for exploration, economic growth, and defence becomes increasingly apparent, the industry seems to be evolving faster than anticipated, spurred by political alliances and competition. While political affiliations may deter some customers, they could open doors for competitors in this increasingly competitive market.

(Image Render: Adobe)

01 November 2024

China Pushes Lunar Ambitions, Boeing Considers Space Exit, and Musk & Bezos Stir Space Politics - Space News Roundup

In an article from June 21, we examined China’s rising role as a leader in space exploration and development. We explored how China's approach mirrors its global ambitions to offer alternative paths for global progress, similar to initiatives like the Belt and Road Initiative (BRI). This ambition is evident in China's invitation to expand its cooperation, exemplified through projects like the Tiangong Space Station and the International Lunar Research Station (ILRS). The growing space leader seems committed to this path, showing no signs of slowing down.

Writing in Foreign Affairs in June, Elizabeth Economy argued that China is providing an alternative global system that “advances the interests of the world’s people,” citing President Xi’s statement that China has established the “largest platform for international cooperation” (Foreign Affairs, 2024). China also appears to be strengthening ties with the United Nations and, in space governance, preferring to remain closely aligned with the UN, as appose to a US-led Artemis Accords model.

China’s policy of open international collaboration was praised this week by Global Times, which noted China’s efforts to create an “excellent platform” for international cooperation on lunar exploration. By last year, China had signed over 150 intergovernmental agreements with more than 50 countries and international organisations (Global Times, 2024).

Interestingly, the Global Times described lunar exploration as both “competition and collaboration”, a concept that seems increasingly relevant as the US-China race unfolds. According to a statement by the China Manned Space Agency (CMSA) on Tuesday, China is advancing plans for a crewed lunar landing with the goal of reaching the Moon by 2030. CMSA also announced the selection of two teams from the China Academy of Space Technology (CAST) and the Shanghai Academy of Spaceflight Technology (SAST) to develop a lunar rover to transport taikonauts over short distances on the Moon.

Additionally, this week, the Shenzhou-19 crew heading to the Tiangong station will conduct experiments with “lunar bricks” made from simulated lunar soil to test their viability for constructing their future lunar base. While the US still leads with more countries signed onto its Artemis Accords, China’s steady progress and partnerships indicate an increasingly competitive race.

Boeing Reportedly Looking to Sell Space Business – Sign of an Industry Shift?

China’s ascent in space signals a new era, transitioning from an industry once dominated by a few national agencies to one led by diverse stakeholders, including new spacefaring nations, commercial players, and civil society.

Last Friday, The Wall Street Journal reported that Boeing, once a leader in space technology, responsible for developing the Saturn V rockets and the Space Shuttle, is considering exiting the space sector. Plagued by delays and cost overruns in its Starliner program, Boeing has struggled to compete with SpaceX in transporting crew and cargo to the ISS. Similar issues have impacted its work on NASA’s Space Launch System (SLS) rocket, with ongoing engineering setbacks and budget excesses. Meanwhile, Airbus also recently announced layoffs, planning to cut 2,500 jobs in its space and defence sectors by 2026.

SpaceX now dominates space launches and is advancing the development of its heavy-lift reusable vehicle, Starship. Meanwhile, companies like Sierra Space, Voyager, and Vast are pioneering new alternatives to the aging IS, arenas once dominated by Boeing. These challenges highlight an industry shift, as legacy companies are increasingly overshadowed by younger, more agile competitors.

(Image: Terry White/SLS)

Boeing’s Setbacks as Opportunities for New Players

In November 2023, the European Space Agency (ESA) decided to embrace a commercial approach to rocket development. Rather than build its own rockets, ESA will now stimulate competition and purchase launch services “as an anchor customer,” according to ESA Director Josef Aschbacher. This decision could mark a turning point for Europe, with the new Ariane-6 rocket possibly the last of a legacy series as ESA shifts to procuring services instead of commissioning rockets.

In line with this strategy, ESA announced this week that it awarded contracts to four European companies to develop reusable rocket technologies. The Technologies for High-thrust Reusable Space Transportation (THRUST!) project will fund The Exploration Company (Germany/France) to develop its Typhoon engine, while Rocket Factory Augsburg will create a new engine for the initiative. The Boosters for European Space Transportation (BEST!) project will support reusable booster tech from ArianeGroup (France) and Isar Aerospace.

ESA is also exploring ways to support the European space industry amid challenges like Boeing’s job cuts, potentially marking a moment for Europe to assert its presence on the global space stage.

Could Musk and Bezos’ Politics Open Doors for Competitors?

On Wednesday, October 30, Blue Origin rolled out the first stage of its much-anticipated New Glenn rocket, poised to challenge SpaceX’s Falcon 9. With a larger payload capacity to Low Earth Orbit (LEO) and a fully reusable first stage, New Glenn could become a formidable rival.

However, Blue Origin found itself in the spotlight this week amid reports of meetings with former President Donald Trump. Simultaneously, Bezos banned political campaigning within The Washington Post, sparking controversy and resulting in 200,000 canceled subscriptions. Bezos has stated there is no connection between these events, though the implications for Blue Origin remain uncertain.

Meanwhile, Elon Musk, an outspoken supporter of Trump, recently stated that a Trump administration would benefit SpaceX by reducing regulatory hurdles. Adding to the controversy, The New York Times reported that Musk has held confidential meetings with Vladimir Putin over the past two years, prompting NASA Administrator Bill Nelson to voice concerns. Pentagon officials have also expressed unease about SpaceX developing spy satellites for them, especially given Musk's alleged connections to Putin.

Coincidentally or not, the US Space Force opened applications this week for national security missions from emerging launch providers, possibly signalling new opportunities for companies like Firefly, Rocket Lab, Astra or Relativity Space.

As the value of space for exploration, economic growth, and defence becomes increasingly apparent, the industry seems to be evolving faster than anticipated, spurred by political alliances and competition. While political affiliations may deter some customers, they could open doors for competitors in this increasingly competitive market.

Share this article

01 November 2024

China Pushes Lunar Ambitions, Boeing Considers Space Exit, and Musk & Bezos Stir Space Politics - Space News Roundup

(Image Render: Adobe)

In an article from June 21, we examined China’s rising role as a leader in space exploration and development. We explored how China's approach mirrors its global ambitions to offer alternative paths for global progress, similar to initiatives like the Belt and Road Initiative (BRI). This ambition is evident in China's invitation to expand its cooperation, exemplified through projects like the Tiangong Space Station and the International Lunar Research Station (ILRS). The growing space leader seems committed to this path, showing no signs of slowing down.

Writing in Foreign Affairs in June, Elizabeth Economy argued that China is providing an alternative global system that “advances the interests of the world’s people,” citing President Xi’s statement that China has established the “largest platform for international cooperation” (Foreign Affairs, 2024). China also appears to be strengthening ties with the United Nations and, in space governance, preferring to remain closely aligned with the UN, as appose to a US-led Artemis Accords model.

China’s policy of open international collaboration was praised this week by Global Times, which noted China’s efforts to create an “excellent platform” for international cooperation on lunar exploration. By last year, China had signed over 150 intergovernmental agreements with more than 50 countries and international organisations (Global Times, 2024).

Interestingly, the Global Times described lunar exploration as both “competition and collaboration”, a concept that seems increasingly relevant as the US-China race unfolds. According to a statement by the China Manned Space Agency (CMSA) on Tuesday, China is advancing plans for a crewed lunar landing with the goal of reaching the Moon by 2030. CMSA also announced the selection of two teams from the China Academy of Space Technology (CAST) and the Shanghai Academy of Spaceflight Technology (SAST) to develop a lunar rover to transport taikonauts over short distances on the Moon.

Additionally, this week, the Shenzhou-19 crew heading to the Tiangong station will conduct experiments with “lunar bricks” made from simulated lunar soil to test their viability for constructing their future lunar base. While the US still leads with more countries signed onto its Artemis Accords, China’s steady progress and partnerships indicate an increasingly competitive race.

Boeing Reportedly Looking to Sell Space Business – Sign of an Industry Shift?

China’s ascent in space signals a new era, transitioning from an industry once dominated by a few national agencies to one led by diverse stakeholders, including new spacefaring nations, commercial players, and civil society.

Last Friday, The Wall Street Journal reported that Boeing, once a leader in space technology, responsible for developing the Saturn V rockets and the Space Shuttle, is considering exiting the space sector. Plagued by delays and cost overruns in its Starliner program, Boeing has struggled to compete with SpaceX in transporting crew and cargo to the ISS. Similar issues have impacted its work on NASA’s Space Launch System (SLS) rocket, with ongoing engineering setbacks and budget excesses. Meanwhile, Airbus also recently announced layoffs, planning to cut 2,500 jobs in its space and defence sectors by 2026.

SpaceX now dominates space launches and is advancing the development of its heavy-lift reusable vehicle, Starship. Meanwhile, companies like Sierra Space, Voyager, and Vast are pioneering new alternatives to the aging IS, arenas once dominated by Boeing. These challenges highlight an industry shift, as legacy companies are increasingly overshadowed by younger, more agile competitors.

Lupex rover illustration (Image: Terry White/SLS)

Boeing’s Setbacks as Opportunities for New Players

In November 2023, the European Space Agency (ESA) decided to embrace a commercial approach to rocket development. Rather than build its own rockets, ESA will now stimulate competition and purchase launch services “as an anchor customer,” according to ESA Director Josef Aschbacher. This decision could mark a turning point for Europe, with the new Ariane-6 rocket possibly the last of a legacy series as ESA shifts to procuring services instead of commissioning rockets.

In line with this strategy, ESA announced this week that it awarded contracts to four European companies to develop reusable rocket technologies. The Technologies for High-thrust Reusable Space Transportation (THRUST!) project will fund The Exploration Company (Germany/France) to develop its Typhoon engine, while Rocket Factory Augsburg will create a new engine for the initiative. The Boosters for European Space Transportation (BEST!) project will support reusable booster tech from ArianeGroup (France) and Isar Aerospace.

ESA is also exploring ways to support the European space industry amid challenges like Boeing’s job cuts, potentially marking a moment for Europe to assert its presence on the global space stage.

Could Musk and Bezos’ Politics Open Doors for Competitors?

On Wednesday, October 30, Blue Origin rolled out the first stage of its much-anticipated New Glenn rocket, poised to challenge SpaceX’s Falcon 9. With a larger payload capacity to Low Earth Orbit (LEO) and a fully reusable first stage, New Glenn could become a formidable rival.

However, Blue Origin found itself in the spotlight this week amid reports of meetings with former President Donald Trump. Simultaneously, Bezos banned political campaigning within The Washington Post, sparking controversy and resulting in 200,000 canceled subscriptions. Bezos has stated there is no connection between these events, though the implications for Blue Origin remain uncertain.

Meanwhile, Elon Musk, an outspoken supporter of Trump, recently stated that a Trump administration would benefit SpaceX by reducing regulatory hurdles. Adding to the controversy, The New York Times reported that Musk has held confidential meetings with Vladimir Putin over the past two years, prompting NASA Administrator Bill Nelson to voice concerns. Pentagon officials have also expressed unease about SpaceX developing spy satellites for them, especially given Musk's alleged connections to Putin.

Coincidentally or not, the US Space Force opened applications this week for national security missions from emerging launch providers, possibly signalling new opportunities for companies like Firefly, Rocket Lab, Astra or Relativity Space.

As the value of space for exploration, economic growth, and defence becomes increasingly apparent, the industry seems to be evolving faster than anticipated, spurred by political alliances and competition. While political affiliations may deter some customers, they could open doors for competitors in this increasingly competitive market.

Share this article