17 March 2023

Despite the challenges, New Space keeps marching on

(Image: Adobe Stock)

Challenges persist, not only in the space industry, but on a global level. The changing relationship between Russia, China and western nations is paving the way for heightened geopolitical tensions, and it appears that world may be entering a new Cold War. What could be more worrisome is the use of ideologically-fuelled language; the defence of sovereignty, the rights to self-determined democracy, and growing comparisons to 1930s Europe.

Mercy Kuo writing for The Diplomat this week analysed this changing international order and the challenge in US-EU relations, saying that “Russia and China promote an alternative vision of international order, one clearly distinct from that upheld by the U.S. and the EU.” This rhetoric seems to be true, and in space as elsewhere, it’s forcing a shifting of relations. ESA’s decision to step away from China’s Tiangong space station appears to have been a political one, perhaps as an attempt to not support China’s vision of a new world order, whilst European nations such as Germany find themselves in a difficult halfway house, having ideological allegiance to the west, but also acknowledging China as a major trading partner.

Whatever the truth may be, this is causing a challenges for space companies, on top of the fallout from the Ukraine invasion, Russian sanctions, supply chain issues and a global economic downturn. Yet at the same time, we continue to see positive activity in the space sector, with stakeholders increasingly seeing the value that New Space has in our future.

Financial, technical and political constraints remain

Even without the geopolitical issue, space companies of course still have to contend with technical constraints, and in the past week this was the case for launch company, Relativity Space. The company has now scrubbed two attempts at the first launch of their largely 3D-printed Terran-1 rocket, which would pave the way for their fully-reusable Terran-R, seen as a direct challenger to SpaceX’s workhorse Falcon-9 rocket. Delays of this nature are to be expected, and we’ll hopefully learn of a new launch date in the coming days and weeks.

Financial difficulties are also evident and on Thursday Virgin Orbit announced that they will be pausing operations as they look to resolve cashflow issues. The company has recently suffered with a failed attempt at a UK launch in January, and had been reporting financial problems in the third quarter of 2022. A statement said that the company “…anticipates providing an update on go-forward operations in the coming weeks.” In more positive news for rival Blue Origin, they expect their New Shepard rocket to return to launches late this year, after a launch attempt was aborted in September, 2022.

Fnancial difficulties may also arise as a result of the collapse of Silicon Valley Bank this week. Prominent space industry names such as Rocket Lab and Astra Space are customers of the bank, and was also known for its work with early-stage startups. Space News reported that an anonymous space entrepreneur said that “It’s a very serious situation…our balance is suddenly only $450.” This may not be a long-term problem for the industry, but for young startups, much in need of early-stage financing, it could cause challenges.

There has also been yet more evidence of geopolitics directly affecting the industry. Since January, Luxembourg-based Spacety, a Chinese space corporation, has been sanctioned by US authorities for their involvement in the war in Ukraine. The company is believed to have supplied imagery to Russia’s Wagner mercenary group. The Ministry of Economy has now taken steps to halt Spacety from supporting Russian war efforts, and University of Luxembourg has suspended cooperation.

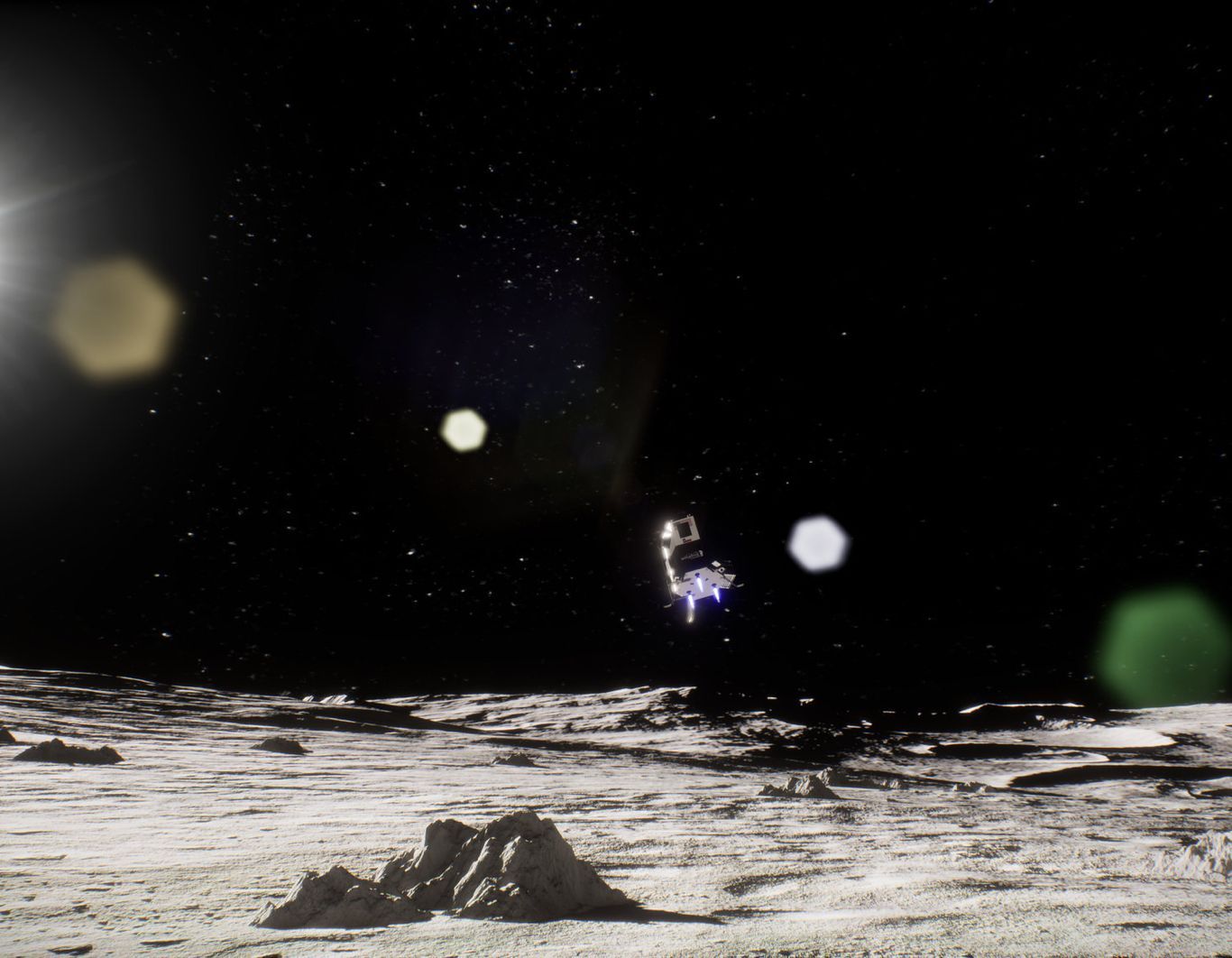

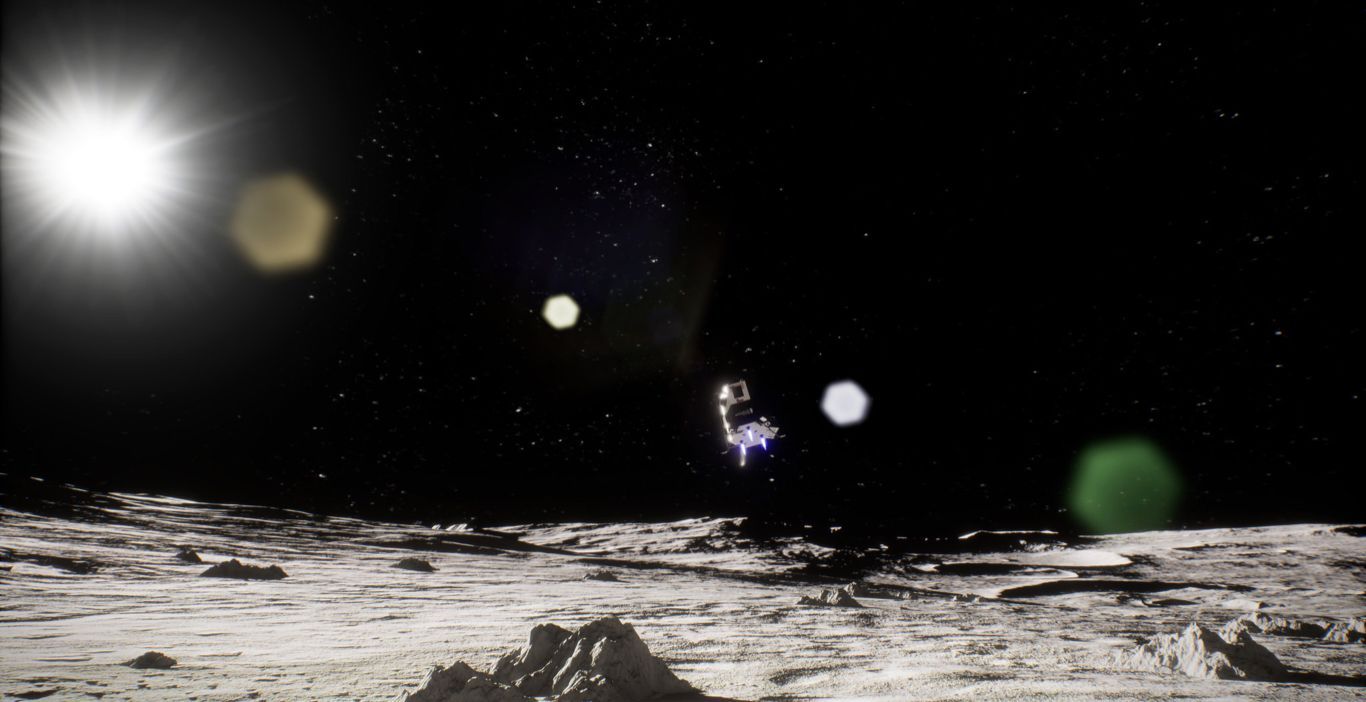

Intuitive Machines to transport Lonestar's data centre (Image: Intuitive Machines)

Much to anticipate in the coming months and years

These aren’t the only challenges that industry will face in the coming weeks, months and years, and especially as we see the ideological gap widen, and nations tussle for leadership in New Space. Nonetheless, despite these looming threats, the industry is still witnessing positive signs of growth, and increasing activity. Adding more optimism to the market, Mark Baggot, chief executive of Seraphim Space, estimated that funding in the industry dropped by 25% in 2022 over 2021, but expected a return to 2021 levels this year.

Other stakeholders are also benefitting from positive financial news this week. South Korea has announced that it will establish a $39 million fund for its space startups, looking to foster growth in its native space industry. Similarly, Lonestar Data Holdings has raised an additional $5 million for its plans to establish lunar data centers. The company plans to send a proof-of-concept data centre to the Moon later this year with lunar landing company, Intuitive Machines. Nokia will also attempt to establish a 4G LTE network on the Moon as part of the same mission.

There have been positive developments with German space group OHB, who have announced a year-on-year sales increase of around 4%, and could have a more success if launch company RFA have a successful launch this year, as Europe races for sovereign access to space. OHB is a shareholder in RFA.

We’ve also seen positive technical technical results. Scotland’s SaxaVord spaceport, announced the development of two cleanrooms and an air lock, enabling SaxaVord to host satellites of up to 1,000kg. Germany’s RFA are just one company looking to utilise the site for their first launch, and is another positive development regarding European launch access.

Europe is also ploughing ahead with its Space-Based Solar Power (SBSP) plans, with Lockheed Martin announcing a £150,000 investment to Northumbria University (UK), in project aimed at SBSP. ESA has already announced its Solaris project, looking to research the feasibility of SBSP by 2025. The University’s project will look into using solar power for future space and lunar vehicles, but SBSP is also seen as a possible future source of limitless clean energy that could be beamed back to Earth.

We will soon also see the beginnings of Amazon’s Kuiper megaconstellation, as the company recently unveiled their user-terminals to be ready for use in 2024. Their first prototype satellites are due to launch in May with ULA’s new Vulcan rocket, and will eventually makeup a constellation of well over 3,000 satellites. Amazon Kuiper will also launch with Blue Origin and Arianespace, on their New Glenn and Ariane 6 rockets respectively, although both are yet to carry out their maiden launches.

US launch company Firefly Aerospace have also received positive news this week, as NASA announced it has selected them to land payloads on the far side of the Moon in 2026. The company will use their Blue Ghost lander as part of NASA Commercial Lunar Payload Services (CLPS) programme. Firefly are just another company to play a part in the commercialisation of the Moon, and it’s only a matter of weeks until we witness the first commercial lunar landing with Japanese company, iSpace.

Lastly, Voyager Space have been building on plans for their commercial space station, Starlab, through the acquisition of ZIN Technologies. ZIN has previously flown microgravity equipment and spaceflight hardware on the ISS and the Space Shuttle. As the ISS comes closer to retirement, commercial stations will be vital for the US and its allies to maintain a presence in Earth orbit, and are also being developed by companies such as Blue Origin and Axiom.

Despite the challenges that the industry faces, we are set to see many milestones in space, in orbit, on the Moon and beyond. While nations and companies struggle with the fallout from degrading international relations, the Ukraine invasion and a perilous economic forecast, maybe space can be the light that guides us.

External Links

This Week

*News articles posted here are not property of ANASDA GmbH and belong to their respected owners. Postings here are external links only.

Our future in space

(Image: Adobe Stock)

17 March 2023

Despite the challenges, New Space keeps marching on

Challenges persist, not only in the space industry, but on a global level. The changing relationship between Russia, China and western nations is paving the way for heightened geopolitical tensions, and it appears that world may be entering a new Cold War. What could be more worrisome is the use of ideologically-fuelled language; the defence of sovereignty, the rights to self-determined democracy, and growing comparisons to 1930s Europe.

Mercy Kuo writing for The Diplomat this week analysed this changing international order and the challenge in US-EU relations, saying that “Russia and China promote an alternative vision of international order, one clearly distinct from that upheld by the U.S. and the EU.” This rhetoric seems to be true, and in space as elsewhere, it’s forcing a shifting of relations. ESA’s decision to step away from China’s Tiangong space station appears to have been a political one, perhaps as an attempt to not support China’s vision of a new world order, whilst European nations such as Germany find themselves in a difficult halfway house, having ideological allegiance to the west, but also acknowledging China as a major trading partner.

Whatever the truth may be, this is causing a challenges for space companies, on top of the fallout from the Ukraine invasion, Russian sanctions, supply chain issues and a global economic downturn. Yet at the same time, we continue to see positive activity in the space sector, with stakeholders increasingly seeing the value that New Space has in our future.

Financial, technical and political constraints remain

Even without the geopolitical issue, space companies of course still have to contend with technical constraints, and in the past week this was the case for launch company, Relativity Space. The company has now scrubbed two attempts at the first launch of their largely 3D-printed Terran-1 rocket, which would pave the way for their fully-reusable Terran-R, seen as a direct challenger to SpaceX’s workhorse Falcon-9 rocket. Delays of this nature are to be expected, and we’ll hopefully learn of a new launch date in the coming days and weeks.

Financial difficulties are also evident and on Thursday Virgin Orbit announced that they will be pausing operations as they look to resolve cashflow issues. The company has recently suffered with a failed attempt at a UK launch in January, and had been reporting financial problems in the third quarter of 2022. A statement said that the company “…anticipates providing an update on go-forward operations in the coming weeks.” In more positive news for rival Blue Origin, they expect their New Shepard rocket to return to launches late this year, after a launch attempt was aborted in September, 2022.

Fnancial difficulties may also arise as a result of the collapse of Silicon Valley Bank this week. Prominent space industry names such as Rocket Lab and Astra Space are customers of the bank, and was also known for its work with early-stage startups. Space News reported that an anonymous space entrepreneur said that “It’s a very serious situation…our balance is suddenly only $450.” This may not be a long-term problem for the industry, but for young startups, much in need of early-stage financing, it could cause challenges.

There has also been yet more evidence of geopolitics directly affecting the industry. Since January, Luxembourg-based Spacety, a Chinese space corporation, has been sanctioned by US authorities for their involvement in the war in Ukraine. The company is believed to have supplied imagery to Russia’s Wagner mercenary group. The Ministry of Economy has now taken steps to halt Spacety from supporting Russian war efforts, and University of Luxembourg has suspended cooperation.

Intuitive Machines to transport Lonestar's data centre (Image: Intuitive Machines)

Much to anticipate in the coming months and years

These aren’t the only challenges that industry will face in the coming weeks, months and years, and especially as we see the ideological gap widen, and nations tussle for leadership in New Space. Nonetheless, despite these looming threats, the industry is still witnessing positive signs of growth, and increasing activity. Adding more optimism to the market, Mark Baggot, chief executive of Seraphim Space, estimated that funding in the industry dropped by 25% in 2022 over 2021, but expected a return to 2021 levels this year.

Other stakeholders are also benefitting from positive financial news this week. South Korea has announced that it will establish a $39 million fund for its space startups, looking to foster growth in its native space industry. Similarly, Lonestar Data Holdings has raised an additional $5 million for its plans to establish lunar data centers. The company plans to send a proof-of-concept data centre to the Moon later this year with lunar landing company, Intuitive Machines. Nokia will also attempt to establish a 4G LTE network on the Moon as part of the same mission.

There have been positive developments with German space group OHB, who have announced a year-on-year sales increase of around 4%, and could have a more success if launch company RFA have a successful launch this year, as Europe races for sovereign access to space. OHB is a shareholder in RFA.

We’ve also seen positive technical technical results. Scotland’s SaxaVord spaceport, announced the development of two cleanrooms and an air lock, enabling SaxaVord to host satellites of up to 1,000kg. Germany’s RFA are just one company looking to utilise the site for their first launch, and is another positive development regarding European launch access.

Europe is also ploughing ahead with its Space-Based Solar Power (SBSP) plans, with Lockheed Martin announcing a £150,000 investment to Northumbria University (UK), in project aimed at SBSP. ESA has already announced its Solaris project, looking to research the feasibility of SBSP by 2025. The University’s project will look into using solar power for future space and lunar vehicles, but SBSP is also seen as a possible future source of limitless clean energy that could be beamed back to Earth.

We will soon also see the beginnings of Amazon’s Kuiper megaconstellation, as the company recently unveiled their user-terminals to be ready for use in 2024. Their first prototype satellites are due to launch in May with ULA’s new Vulcan rocket, and will eventually makeup a constellation of well over 3,000 satellites. Amazon Kuiper will also launch with Blue Origin and Arianespace, on their New Glenn and Ariane 6 rockets respectively, although both are yet to carry out their maiden launches.

US launch company Firefly Aerospace have also received positive news this week, as NASA announced it has selected them to land payloads on the far side of the Moon in 2026. The company will use their Blue Ghost lander as part of NASA Commercial Lunar Payload Services (CLPS) programme. Firefly are just another company to play a part in the commercialisation of the Moon, and it’s only a matter of weeks until we witness the first commercial lunar landing with Japanese company, iSpace.

Lastly, Voyager Space have been building on plans for their commercial space station, Starlab, through the acquisition of ZIN Technologies. ZIN has previously flown microgravity equipment and spaceflight hardware on the ISS and the Space Shuttle. As the ISS comes closer to retirement, commercial stations will be vital for the US and its allies to maintain a presence in Earth orbit, and are also being developed by companies such as Blue Origin and Axiom.

Despite the challenges that the industry faces, we are set to see many milestones in space, in orbit, on the Moon and beyond. While nations and companies struggle with the fallout from degrading international relations, the Ukraine invasion and a perilous economic forecast, maybe space can be the light that guides us.

Share this article

External Links

This Week

*News articles posted here are not property of ANASDA GmbH and belong to their respected owners. Postings here are external links only.

17 March 2023

Despite the challenges, New Space keeps marching on

(Image: Adobe Stock)

Challenges persist, not only in the space industry, but on a global level. The changing relationship between Russia, China and western nations is paving the way for heightened geopolitical tensions, and it appears that world may be entering a new Cold War. What could be more worrisome is the use of ideologically-fuelled language; the defence of sovereignty, the rights to self-determined democracy, and growing comparisons to 1930s Europe.

Mercy Kuo writing for The Diplomat this week analysed this changing international order and the challenge in US-EU relations, saying that “Russia and China promote an alternative vision of international order, one clearly distinct from that upheld by the U.S. and the EU.” This rhetoric seems to be true, and in space as elsewhere, it’s forcing a shifting of relations. ESA’s decision to step away from China’s Tiangong space station appears to have been a political one, perhaps as an attempt to not support China’s vision of a new world order, whilst European nations such as Germany find themselves in a difficult halfway house, having ideological allegiance to the west, but also acknowledging China as a major trading partner.

Whatever the truth may be, this is causing a challenges for space companies, on top of the fallout from the Ukraine invasion, Russian sanctions, supply chain issues and a global economic downturn. Yet at the same time, we continue to see positive activity in the space sector, with stakeholders increasingly seeing the value that New Space has in our future.

Financial, technical and political constraints remain

Even without the geopolitical issue, space companies of course still have to contend with technical constraints, and in the past week this was the case for launch company, Relativity Space. The company has now scrubbed two attempts at the first launch of their largely 3D-printed Terran-1 rocket, which would pave the way for their fully-reusable Terran-R, seen as a direct challenger to SpaceX’s workhorse Falcon-9 rocket. Delays of this nature are to be expected, and we’ll hopefully learn of a new launch date in the coming days and weeks.

Financial difficulties are also evident and on Thursday Virgin Orbit announced that they will be pausing operations as they look to resolve cashflow issues. The company has recently suffered with a failed attempt at a UK launch in January, and had been reporting financial problems in the third quarter of 2022. A statement said that the company “…anticipates providing an update on go-forward operations in the coming weeks.” In more positive news for rival Blue Origin, they expect their New Shepard rocket to return to launches late this year, after a launch attempt was aborted in September, 2022.

Fnancial difficulties may also arise as a result of the collapse of Silicon Valley Bank this week. Prominent space industry names such as Rocket Lab and Astra Space are customers of the bank, and was also known for its work with early-stage startups. Space News reported that an anonymous space entrepreneur said that “It’s a very serious situation…our balance is suddenly only $450.” This may not be a long-term problem for the industry, but for young startups, much in need of early-stage financing, it could cause challenges.

There has also been yet more evidence of geopolitics directly affecting the industry. Since January, Luxembourg-based Spacety, a Chinese space corporation, has been sanctioned by US authorities for their involvement in the war in Ukraine. The company is believed to have supplied imagery to Russia’s Wagner mercenary group. The Ministry of Economy has now taken steps to halt Spacety from supporting Russian war efforts, and University of Luxembourg has suspended cooperation.

Intuitive Machines to transport Lonestar's data centre (Image: Intuitive Machines)

Much to anticipate in the coming months and years

These aren’t the only challenges that industry will face in the coming weeks, months and years, and especially as we see the ideological gap widen, and nations tussle for leadership in New Space. Nonetheless, despite these looming threats, the industry is still witnessing positive signs of growth, and increasing activity. Adding more optimism to the market, Mark Baggot, chief executive of Seraphim Space, estimated that funding in the industry dropped by 25% in 2022 over 2021, but expected a return to 2021 levels this year.

Other stakeholders are also benefitting from positive financial news this week. South Korea has announced that it will establish a $39 million fund for its space startups, looking to foster growth in its native space industry. Similarly, Lonestar Data Holdings has raised an additional $5 million for its plans to establish lunar data centers. The company plans to send a proof-of-concept data centre to the Moon later this year with lunar landing company, Intuitive Machines. Nokia will also attempt to establish a 4G LTE network on the Moon as part of the same mission.

There have been positive developments with German space group OHB, who have announced a year-on-year sales increase of around 4%, and could have a more success if launch company RFA have a successful launch this year, as Europe races for sovereign access to space. OHB is a shareholder in RFA.

We’ve also seen positive technical technical results. Scotland’s SaxaVord spaceport, announced the development of two cleanrooms and an air lock, enabling SaxaVord to host satellites of up to 1,000kg. Germany’s RFA are just one company looking to utilise the site for their first launch, and is another positive development regarding European launch access.

Europe is also ploughing ahead with its Space-Based Solar Power (SBSP) plans, with Lockheed Martin announcing a £150,000 investment to Northumbria University (UK), in project aimed at SBSP. ESA has already announced its Solaris project, looking to research the feasibility of SBSP by 2025. The University’s project will look into using solar power for future space and lunar vehicles, but SBSP is also seen as a possible future source of limitless clean energy that could be beamed back to Earth.

We will soon also see the beginnings of Amazon’s Kuiper megaconstellation, as the company recently unveiled their user-terminals to be ready for use in 2024. Their first prototype satellites are due to launch in May with ULA’s new Vulcan rocket, and will eventually makeup a constellation of well over 3,000 satellites. Amazon Kuiper will also launch with Blue Origin and Arianespace, on their New Glenn and Ariane 6 rockets respectively, although both are yet to carry out their maiden launches.

US launch company Firefly Aerospace have also received positive news this week, as NASA announced it has selected them to land payloads on the far side of the Moon in 2026. The company will use their Blue Ghost lander as part of NASA Commercial Lunar Payload Services (CLPS) programme. Firefly are just another company to play a part in the commercialisation of the Moon, and it’s only a matter of weeks until we witness the first commercial lunar landing with Japanese company, iSpace.

Lastly, Voyager Space have been building on plans for their commercial space station, Starlab, through the acquisition of ZIN Technologies. ZIN has previously flown microgravity equipment and spaceflight hardware on the ISS and the Space Shuttle. As the ISS comes closer to retirement, commercial stations will be vital for the US and its allies to maintain a presence in Earth orbit, and are also being developed by companies such as Blue Origin and Axiom.

Despite the challenges that the industry faces, we are set to see many milestones in space, in orbit, on the Moon and beyond. While nations and companies struggle with the fallout from degrading international relations, the Ukraine invasion and a perilous economic forecast, maybe space can be the light that guides us.

Share this article

External Links

This Week

*News articles posted here are not property of ANASDA GmbH and belong to their respected owners. Postings here are external links only.